Canadian Personal Finance Tips and Credit Card Reviews

Welcome to CanuckFinance.ca. Honest reviews and practical advice on credit cards, banking, and personal finance.

Personal Finance Blog

How to Run a Weekly Money Check-In (in 15 Minutes)

Investing vs. Saving: Which Should You Prioritize First?

5 Passive Investing Strategies for Beginners

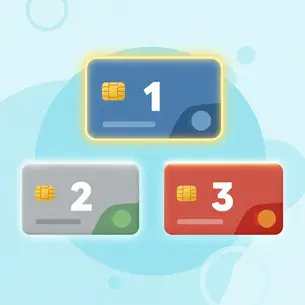

Top 3 Credit Cards for August 2025: Ranked and Reviewed

How Much Should You Save Each Month? A Simple Formula

How Credit Card Rewards Work: Points, Cashback, and Pitfalls

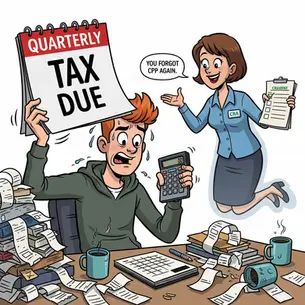

Understanding Quarterly Tax Payments for Self-Employed Individuals

How to Use a TFSA for Investing, Not Just Saving

Featured Credit Cards (August 2025)

Scotiabank Passport® Visa Infinite Card

A travel-focused Visa Infinite card with no foreign transaction fees, solid insurance, and lounge access—designed for Canadians who travel abroad regularly.

No FX Fees

Airport lounge access

Travel Insurance

Rogers™ World Elite® Mastercard®

This card stands out for its high cash-back rates on U.S. dollar purchases and enhanced rewards for Rogers-affiliated customers. The inclusion of travel insurance and lounge access perks adds value, especially for frequent travelers. However, the benefits are most pronounced for those who meet the income criteria and are existing Rogers, Fido, or Shaw customers.

Flat-rate cash back

Extra cash back on Rogers bills

No annual fee

American Express

Cobalt® Card

The American Express Cobalt® Card is a choice for Canadians who prioritize earning rewards on everyday spending, particularly in categories like dining, groceries, and streaming services. Its flexible Membership Rewards program and strong earn rates make it especially appealing to those who can maximize its benefits.

Bonus points on travel & dining

No foreign transaction fees

Flexible points for travel and meals